With every other trade seeming to be selling Puts and Puts Structures to buy Calls and Call structures, this seems to be a hugely crowded trade than is just pushing the Put/Call Skew to record levels. Yes selling Puts makes a lot of sense at these Vol levels, but paying sky high for Calls doesn’t, Market Makers aren’t giving much away here.

As an alternative maybe look at rolling the Puts down the curve, vol out in 2020 is lower, and underlying a lot higher, EDZ9-EDU0 closed at -.535, a recent multi year low.

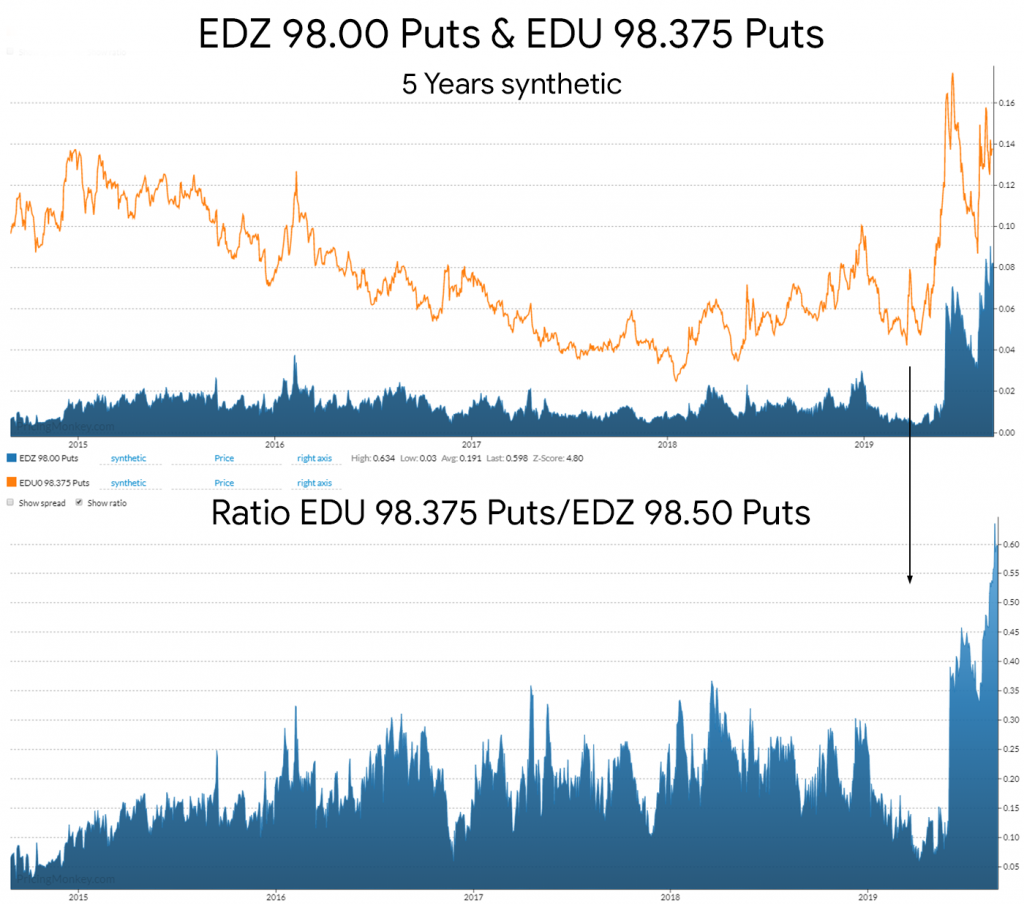

EDZ 98.00 Puts & EDU0 98.375 Puts (expiry 110 days vs. expiry 383 days)

The EDZ puts as a percentage of the EDU0 puts are around 60% (average 19% over the last 5 years).

If you’re wary of year end risks in Eurodollars, look at the EDF (Jan) 98.25 Puts as an alternative.

Another variation would be to sell 2x the EDZ Puts versus the EDU0. This synthetic structure currently sits at 5-Year lows, -0.027 (credit).

Trade booked for tracking