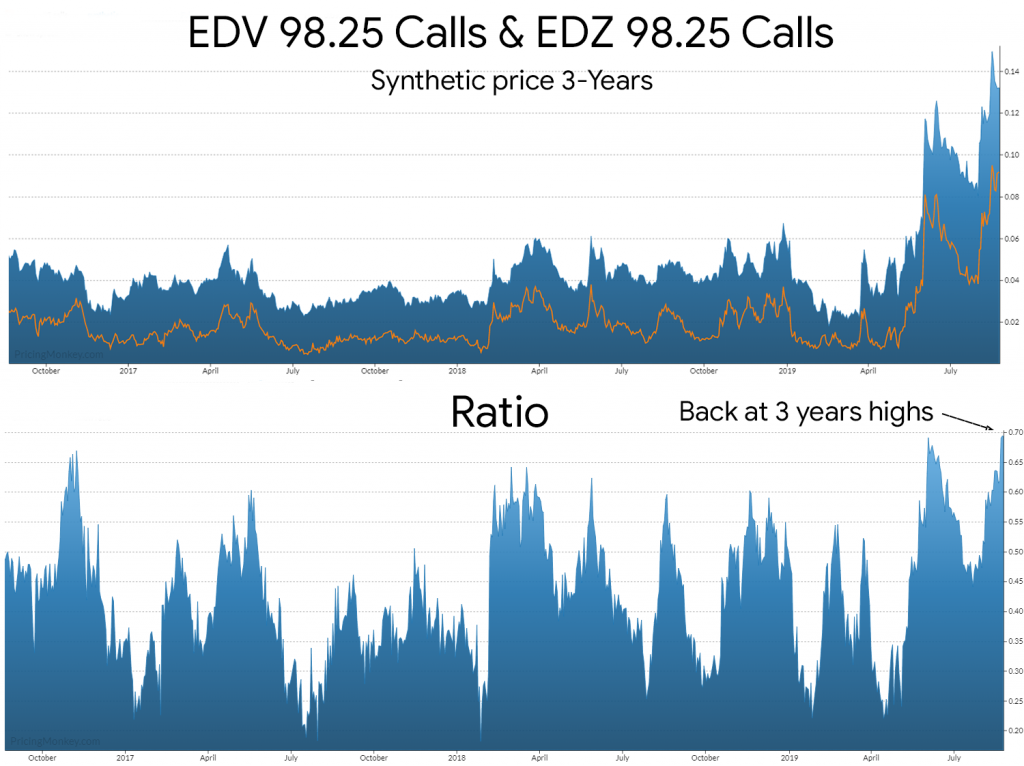

EDV 98.25 Calls (50 days to expiry(Oct), 41% Delta, 0.0014 Vega) vs EDZ 98.25 Calls (115 days to expiry(Dec), 43% Delta, 0.0022 Vega)

If you look at Oct 98.25 Calls divided by Dec 98.25 Calls you can quickly get a view of their relationship, Oct 98.25 Calls are currently 70% of the Dec Call on the back of speculation on the Sep Fed meeting . Dec Calls expire on the 16th Dec 5 days after the Dec Fed meeting, so have 2 Fed meeting in play. A switch looks potentially interesting.

Variation could be to use a Vega weighting to do less Dec and reduce the total cost.

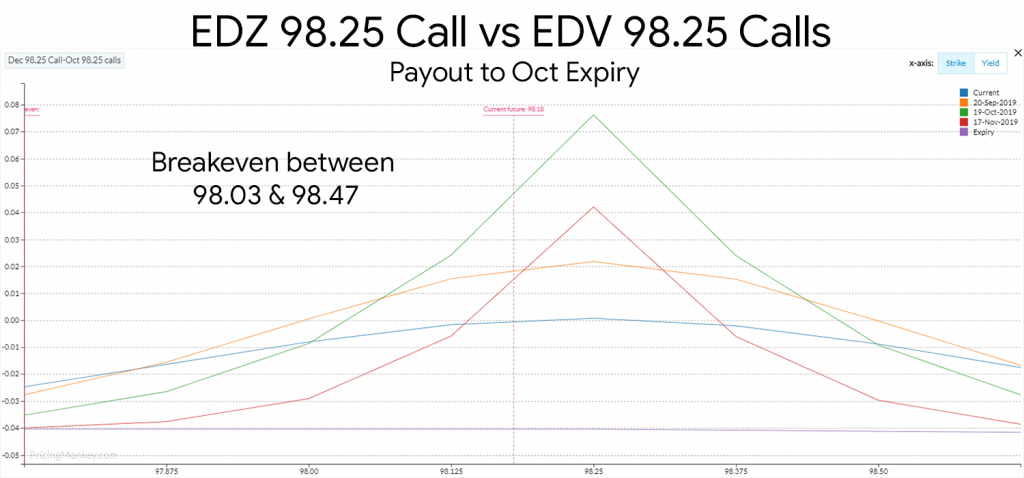

Payout is between 98.03 & 98.47 in the Oct Expiry