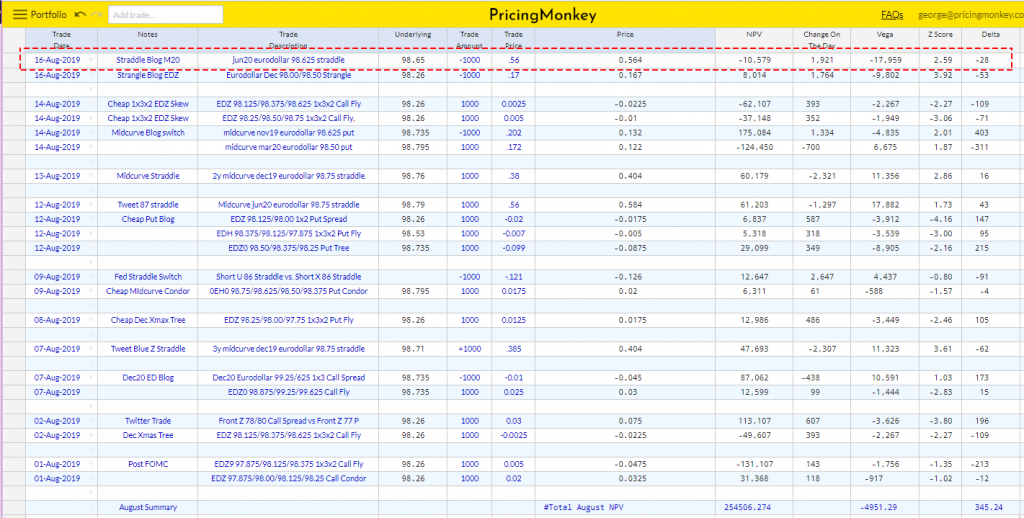

jun20 eurodollar 98.625 straddle, 303 days to expiry, 2.8% delta

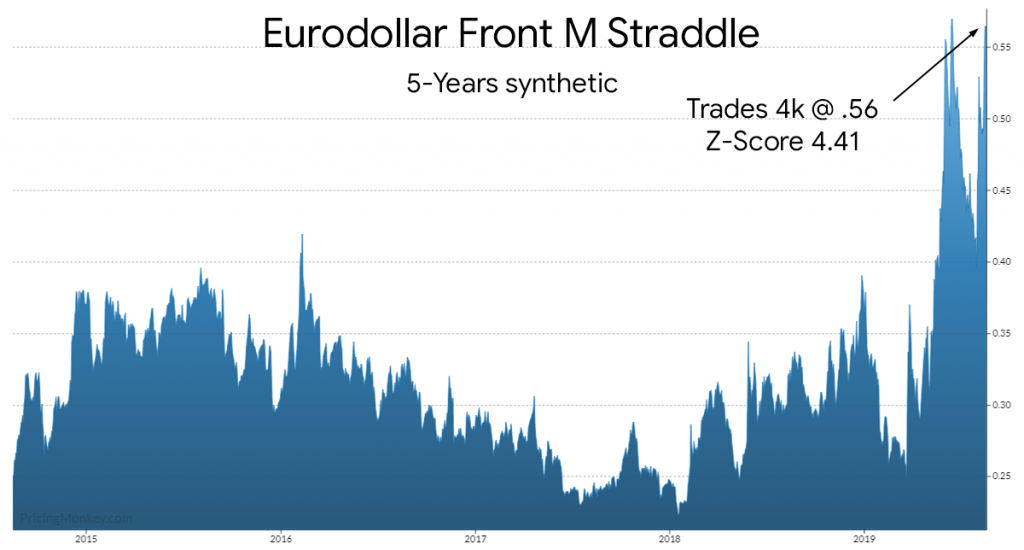

Just ran our analysis on this trade, -4000 at .56 in the Front M Straddle, which looks a reasonable sale based on our historical view.

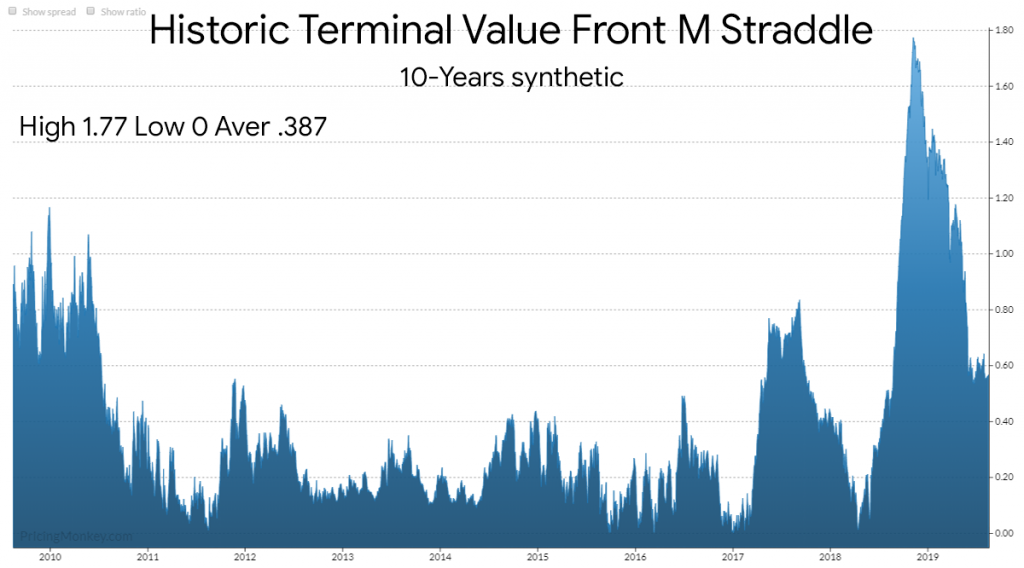

So why might this be an okay sell? If you run our performance function adding back the premium to get the synthetic terminal value of this structure you see its High/Low and Average payouts. Here the average value over 10 years was .387.

Trade booked for monitoring.