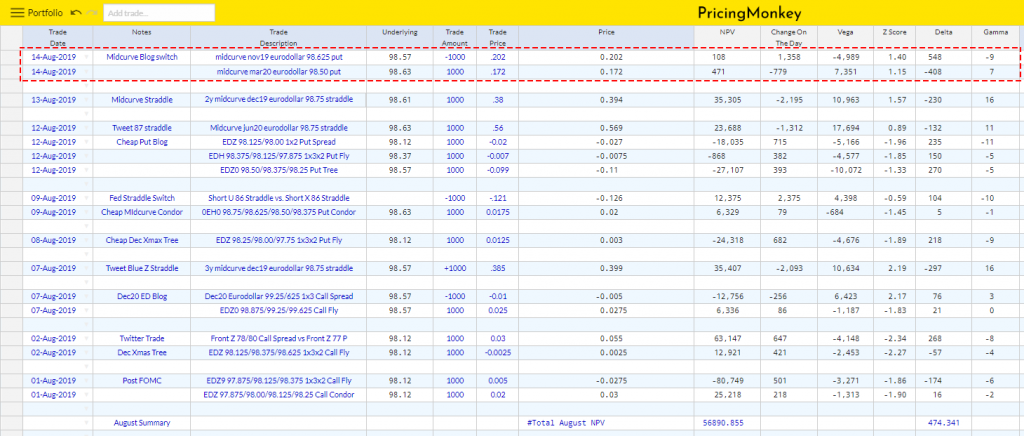

| midcurve nov19 eurodollar 98.625 put (94 days to expiry) – midcurve mar20 eurodollar 98.50 put (212 days to expiry) |

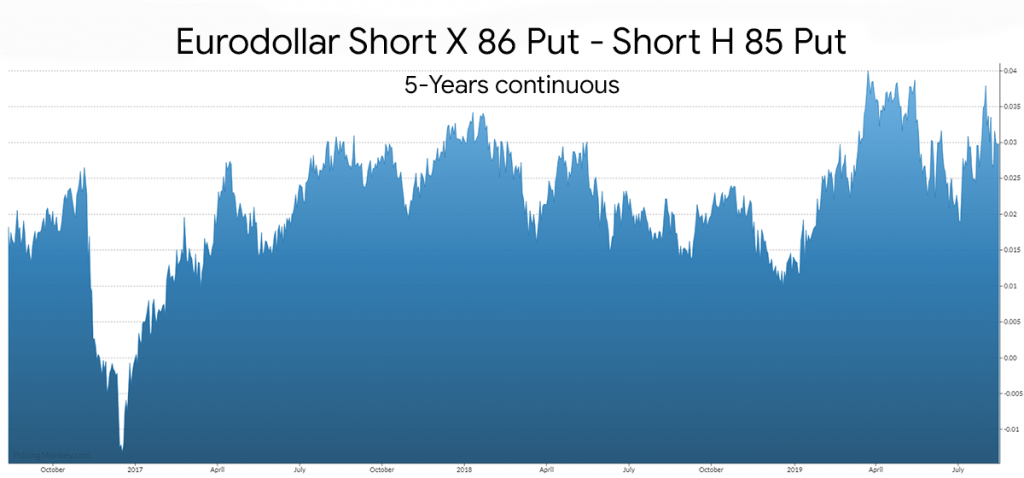

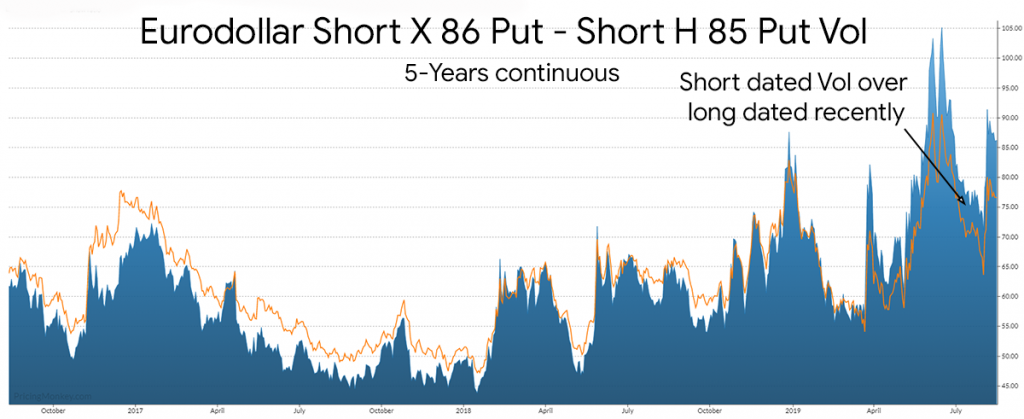

This is a trade we saw being executed yesterday, Short X Puts (94 days, 54 delta) trading versus Short H 85 Puts (212 days, 41 delta), trades for around 0.03. The short duration option trades at a decent premium currently. This might might be worth a look especially if you don’t expect the EDZ0-H1 to widen further or to revert (closed -0.06).

Trade added for tracking