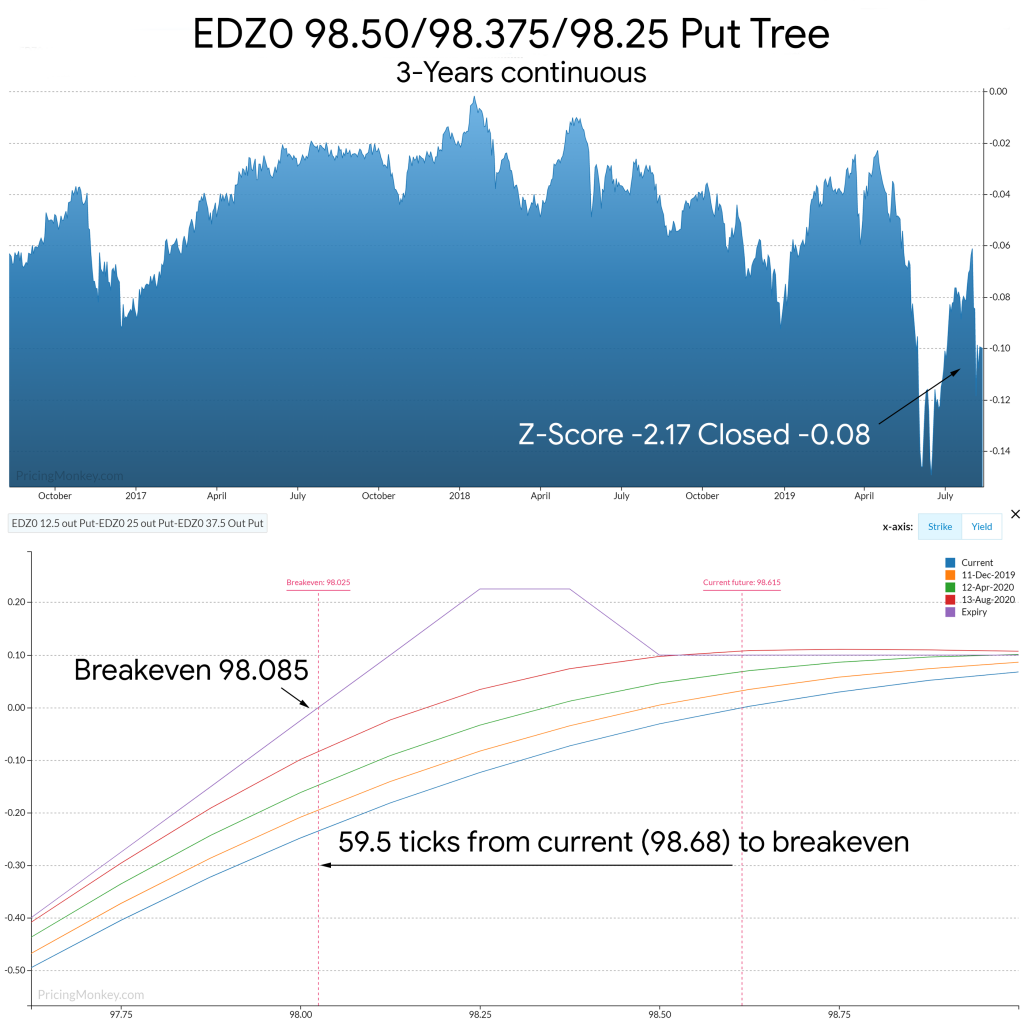

After yesterdays and Friday’s frenzy in 1×2 Call spreads in Eurodollars, we thought it might be good to take a quick look at the much-neglected Puts while everyone is looking the other way. Here are 3 different strategies that might be useful as an RV trade or Hedge, all have positive delta.

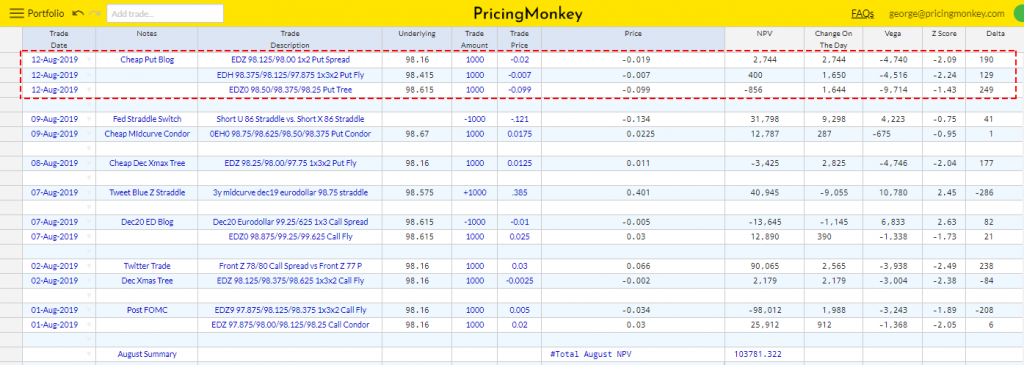

A Dec Put Spread (1×2)

The EDZ 98.125/98.00 1×2 Put Spread, 115 days to expiry with the Futures around 98.16. Trades cheap at -0.01 (Z-Score -3.46, Delta 14.8%) on a synthetic basis, payout @ 98.00.

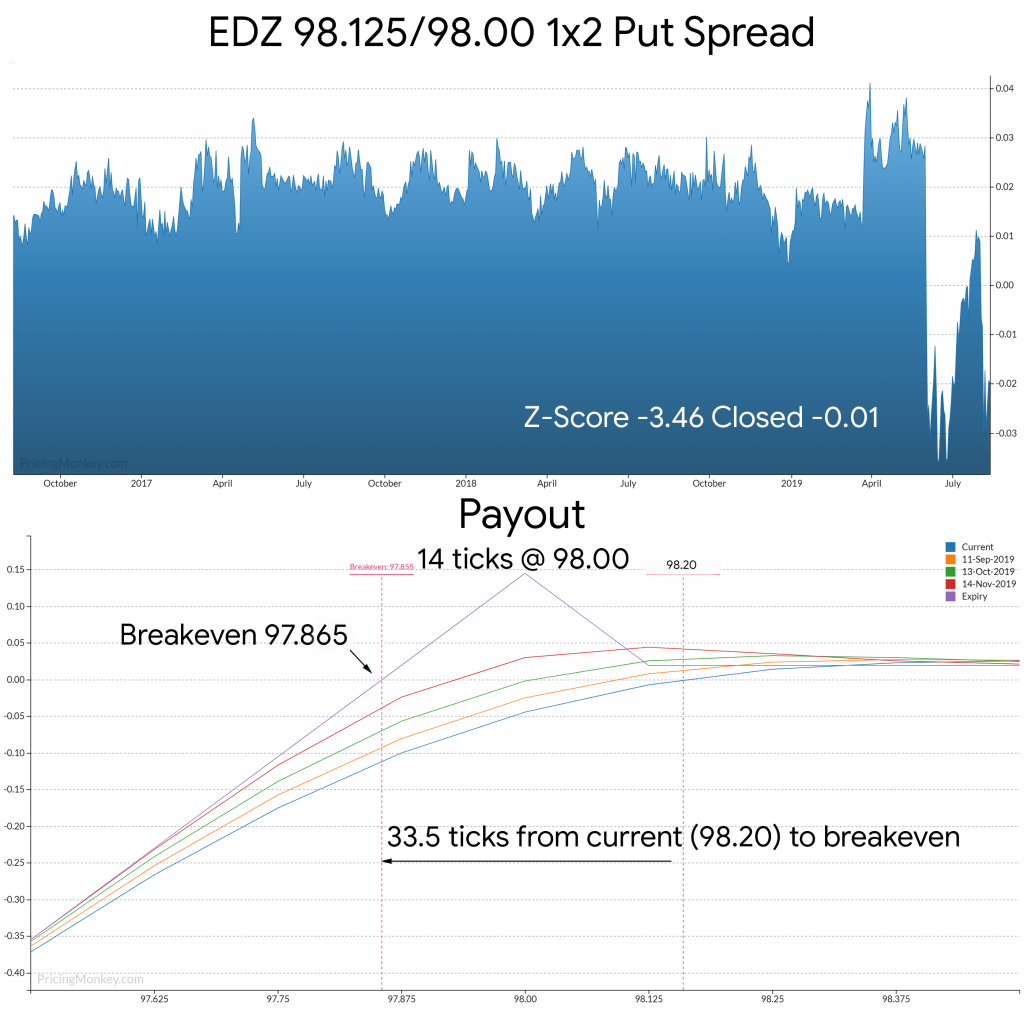

A March 1x3x2 Put Spread (Christmas Tree)

The EDH 98.375/98.125/97.875 1x3x2 Put Fly, 307 days to expiry, with Futures (EDH0) around 98.42 this morning. Closed at 0.0075 (Z-Score -3.55, Delta 9.6%).

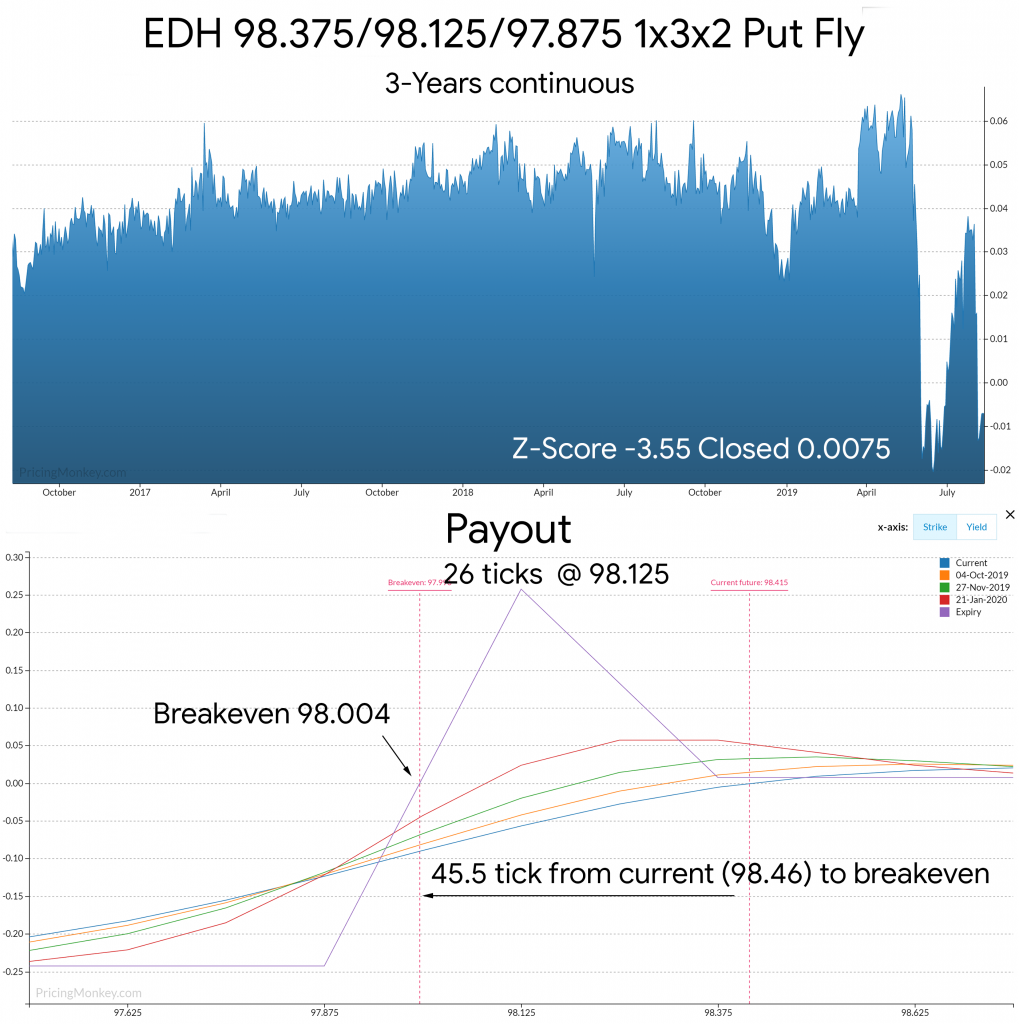

A Dec 20 Put Tree

Another stressed out structure, the EDZ0 98.50/98.375/98.25 Put Tree (+1, -1, -1), closed at -0.08 (Z-Score -2.17, Delta 21.8%, 489 days to expiry).

Trades booked in our Book Running for tracking (Friday)