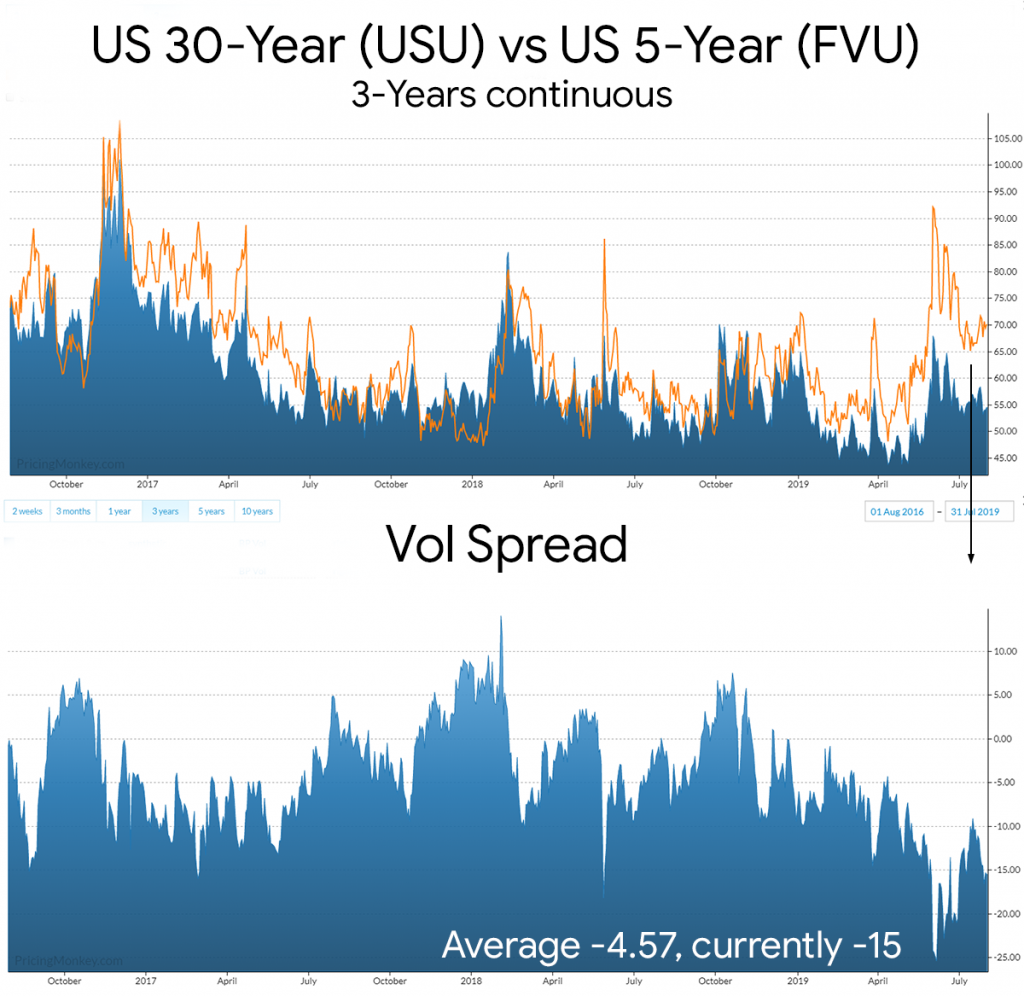

This was a trade we highlighted a couple of weeks ago, and it certainly looks interesting to follow over the next week or so. Over the last 10-Years 30-Year Vol has averaged around 3bp over 5-year Vol, it’s currently around -14 under.

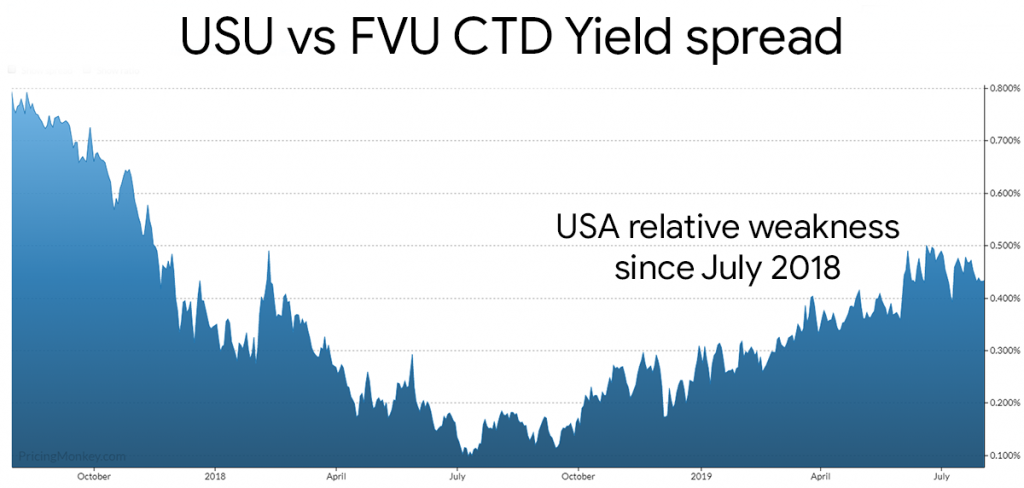

The spread between the 2 contracts also looks interesting. Futures CTD yield spread last 2 years, 30-Year relative weakness since July last year.

Expecting this under performance of 30-Years to continue, we would look to purchase 30 delta USU puts and sell 30 delta FVU puts. This should trade for a credit (ie selling weighted FVU puts will be higher than purchasing USU puts given the Vol difference).

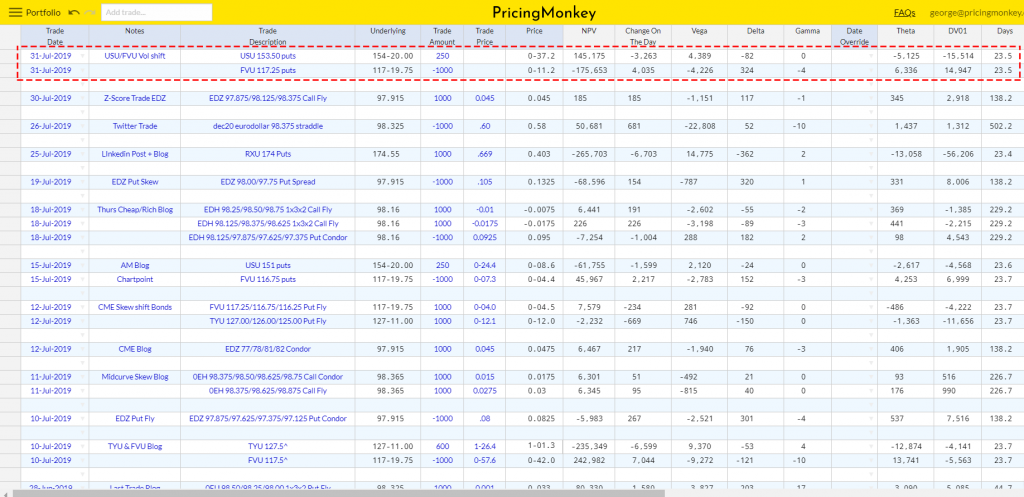

USU 153.50 puts are priced at 0-372, and FVU 117.25 puts at 0-112. Both close to 30 delta. Weighting is around 4/1.