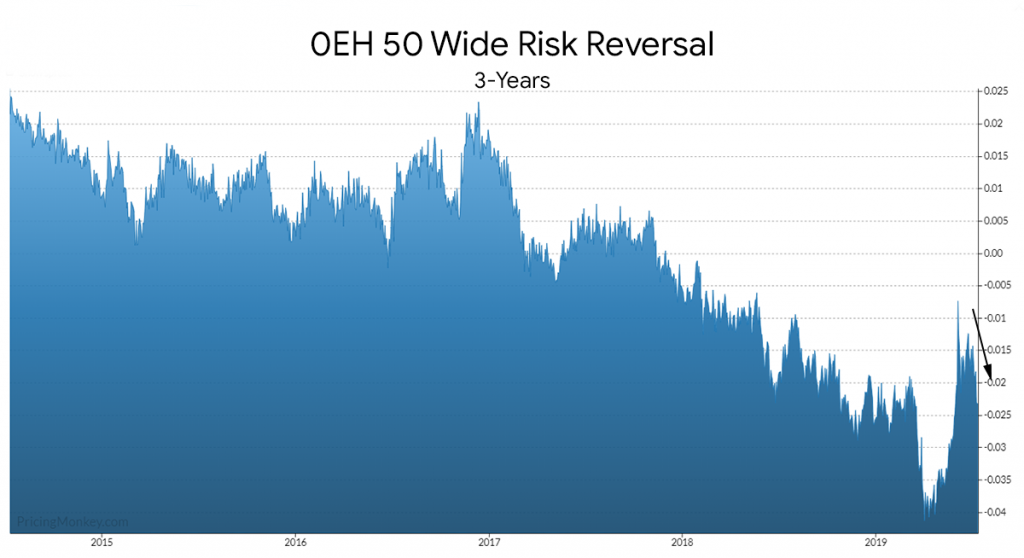

Continuing to see a push in March Midcurve skew which seems to be causing Flys and Condors to cheapen again. For example the synthetic 50 wide OEH Risk Reversal closed at -0.023 (246 days to expiry), clearly shows this Skew shift.

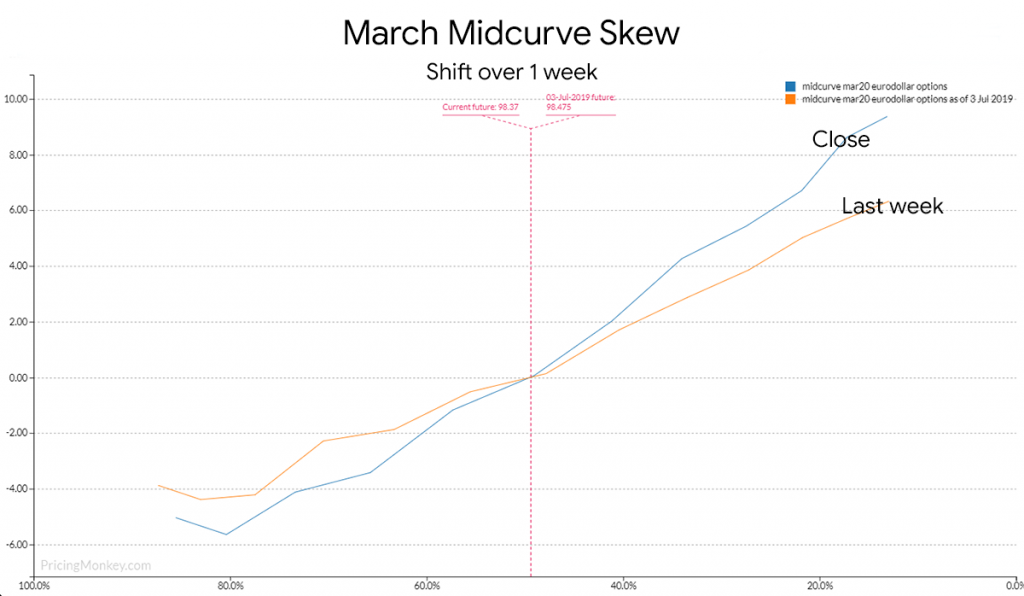

The general shift in the Midcurve Mar (0EH) Skew curve is clearly visible over the week.

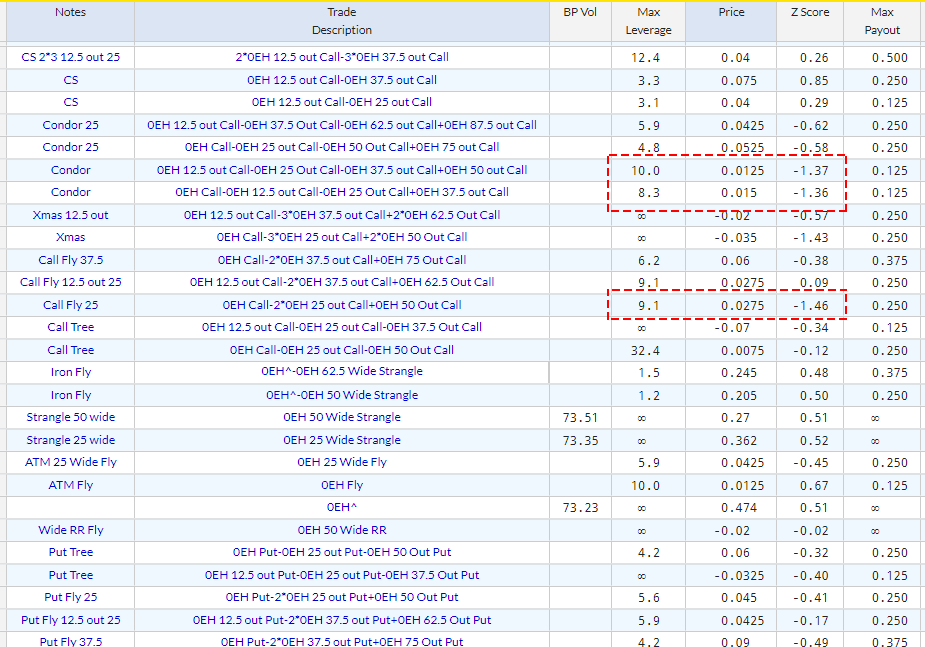

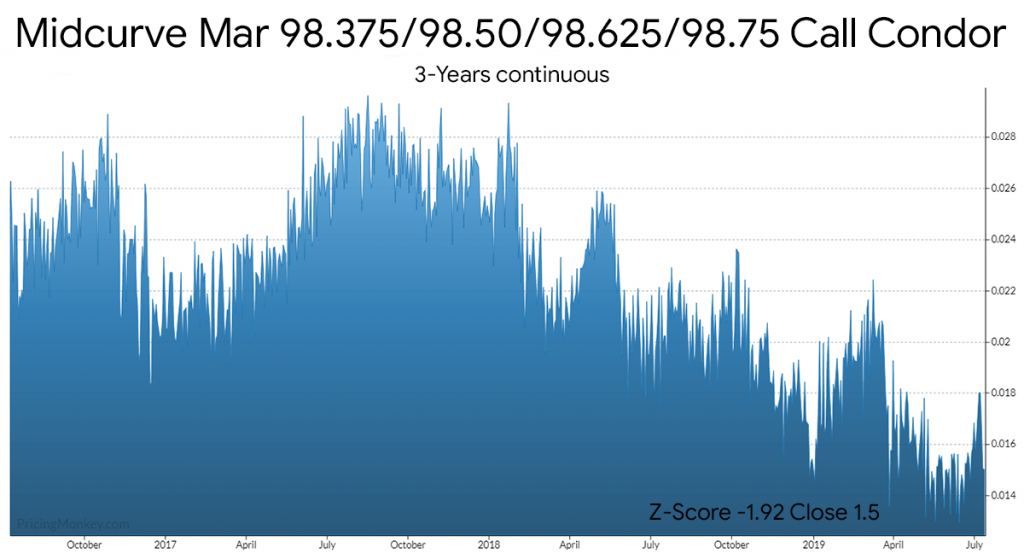

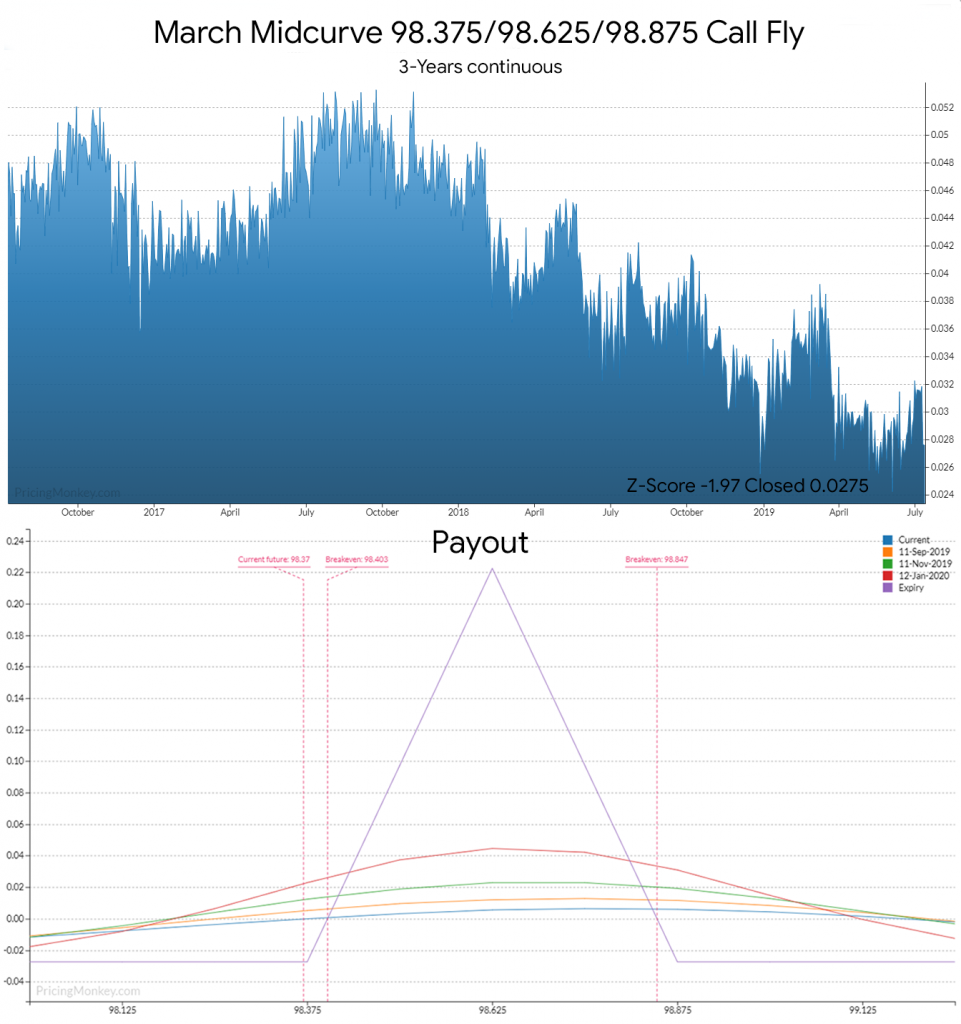

The impact this lift in the Call skew is that it’s causing the Flys and Condors to selectively cheapen.

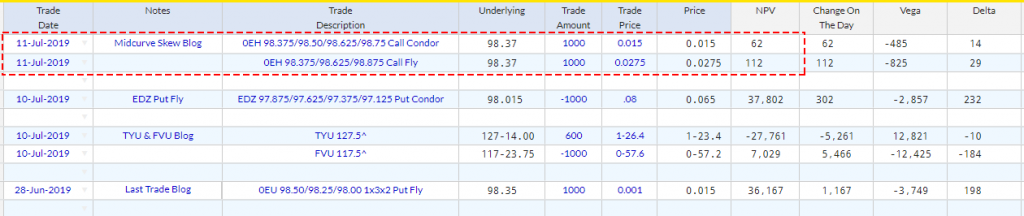

Looking at a couple of the structures highlighted here, the Midcurve Mar 98.375/98.50/98.625/98.75 Call Condor and the March Midcurve 98.375/98.625/98.875 Call Fly you can really see how these are benefiting from the current skew profile.

Dummy trade booked…