With July 4th next week and TY Vol (Aug) around recent highs, plus sitting close to 2% in 10y Note (generic) , we look at a number of strategies for assuming the market will lose some focus, and Vol might drift.

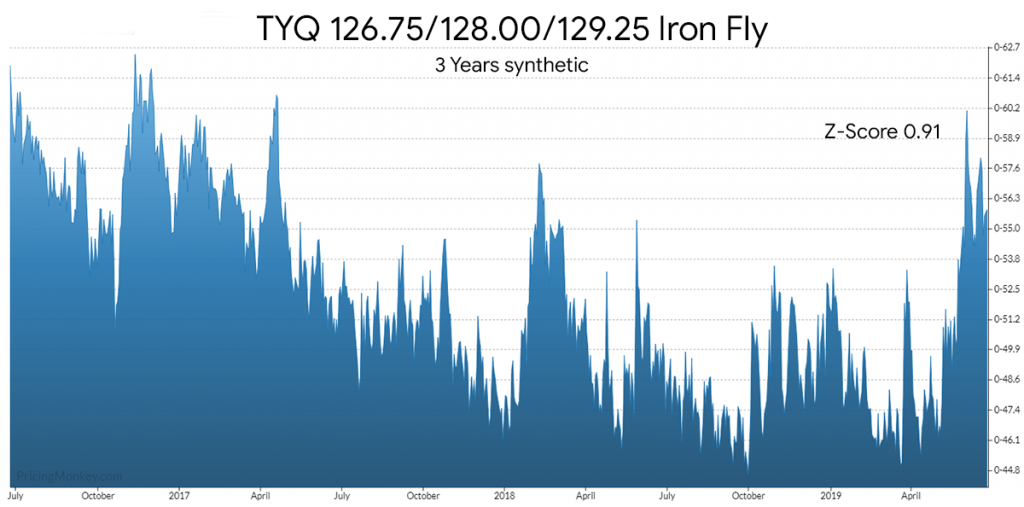

TYQ 126.75/128.00/129.25 Iron Fly

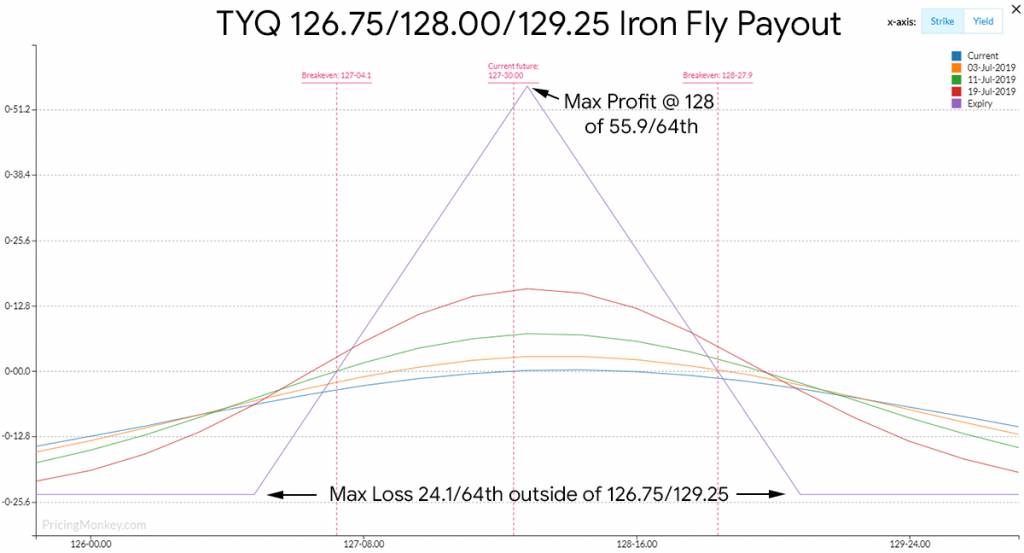

While selling the ATM straddle is the simplest way to short Vol. having liability ∞ doesn’t really fit with our passive approach, but using the Iron Fly which is a TY Straddle – TY Strangle risk is capped.

This closed at 0-55.9/64th last night, anyone buying this structure is looking for a max payout of 1.25 points (1 + 16/64th), just 1.4 x the premium. which if you chart the “Max Leverage” looks low. Has 31.7 days to expiry.

By selling this structure at 55.9/64th you’re at risk of having 1.25 point loss outside of 126.75/129.25, a net 24.1/64th loss (55.9-1 16/64th). A max payout would be 55.9/64th at the current level (128).

Variations to consider

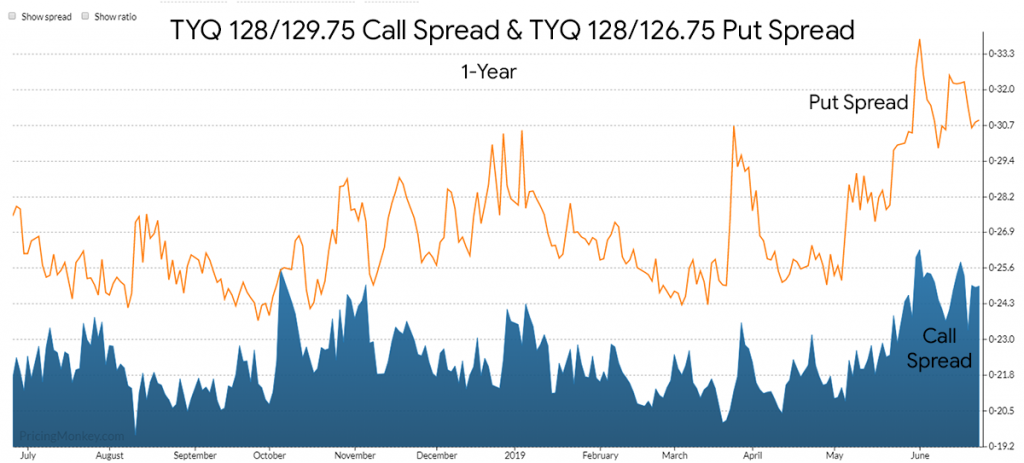

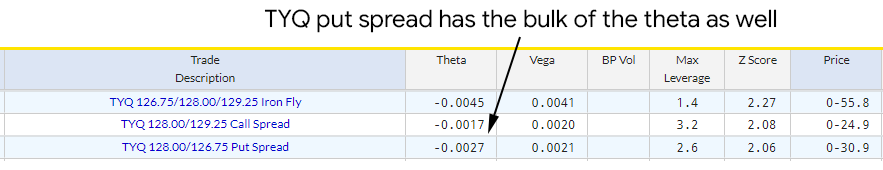

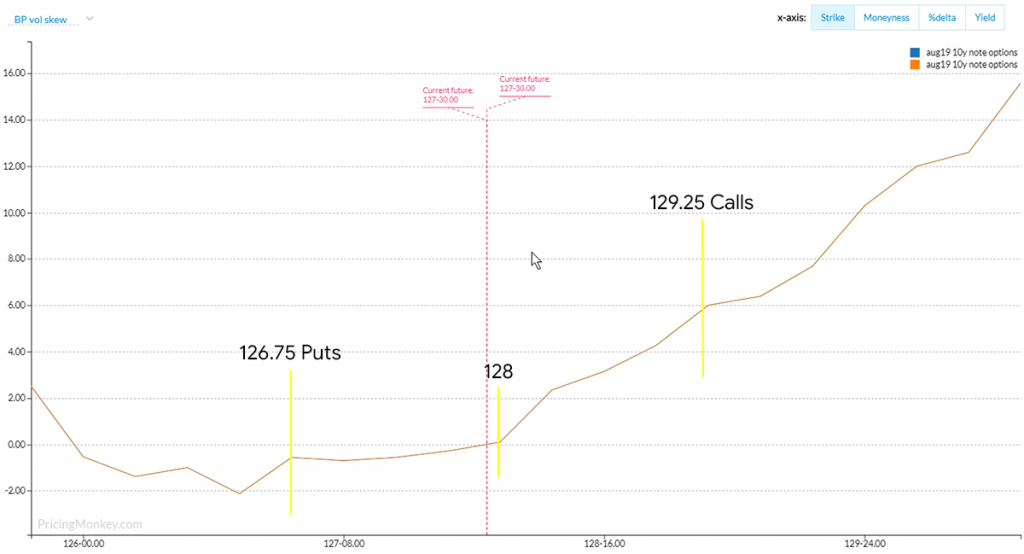

If you have a directional bias then consider the 2 sides of the Iron Fly, either selling the Calls Spread of Selling the Put Spread. The skew makes the Put Spread a better sell.

If you sell the Call or Put spreads you need to buy the out of the money strike, as you can see the out of money puts are much lower.

Dummy Trade booked in our system.