Couple of trades caught our attention yesterday, one was the buying of 3-Year Midcurve vol versus Oct in Puts for a small credit, and the other was weakness and very low close in the at-the-money Mar Midcurve Fly.

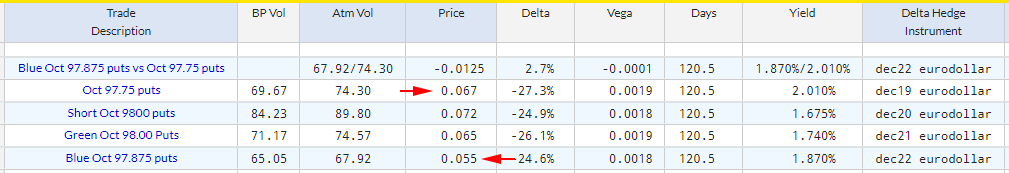

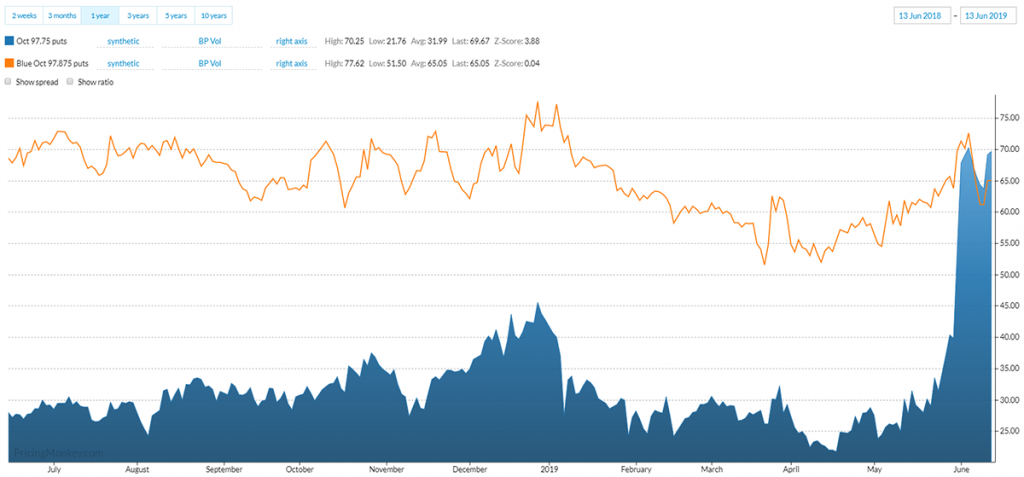

Blue Oct 97.875 puts vs Oct 97.75 puts

This trade printed in at least 25k, a flow of selling front Oct to buy 3-year midcurve 25 delta Puts of 0.005 credit, it closed at -0.0125. If you’re keen to sell vol, it looks like there are a number of potential contracts here that might be worth exploring.

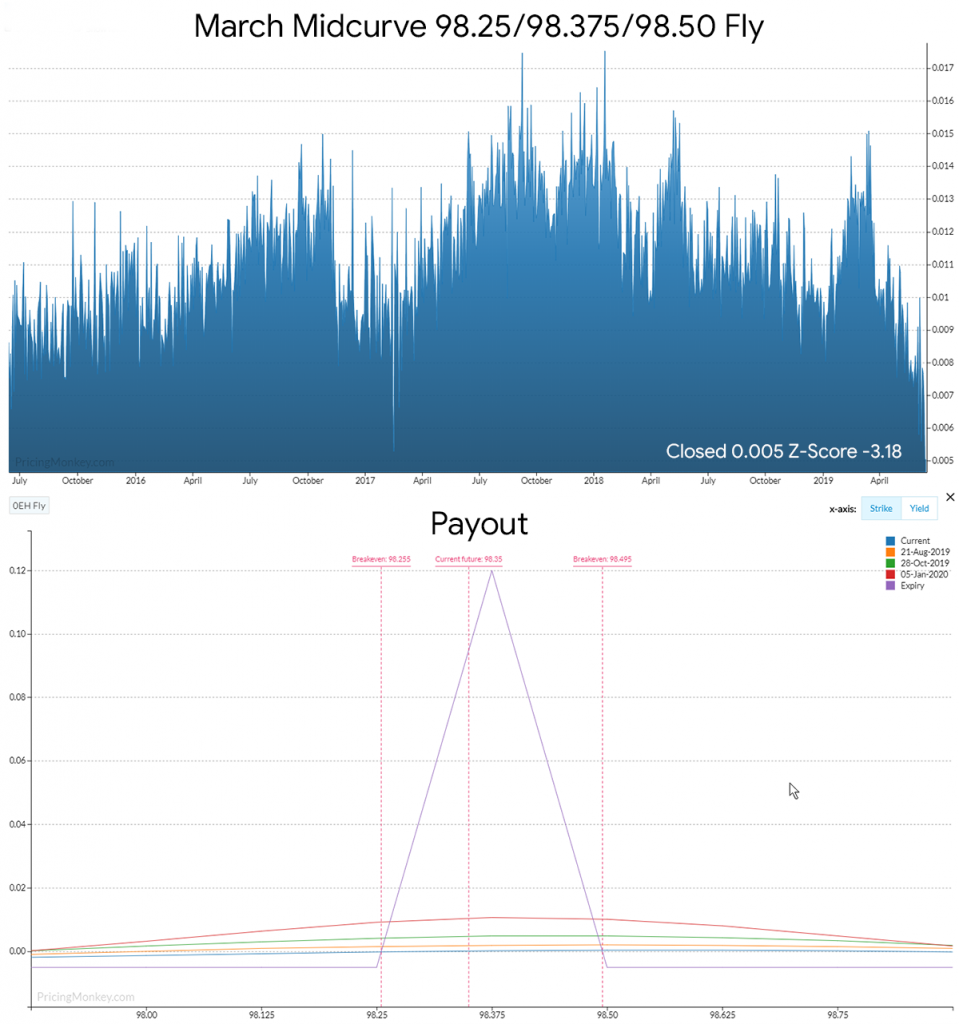

March Midcurve 98.25/98.375/98.50 Fly

Flagged this trade this morning by a customer, definitely worth checking when the market is open. CME closed it at 0.005, which looks very unusual.