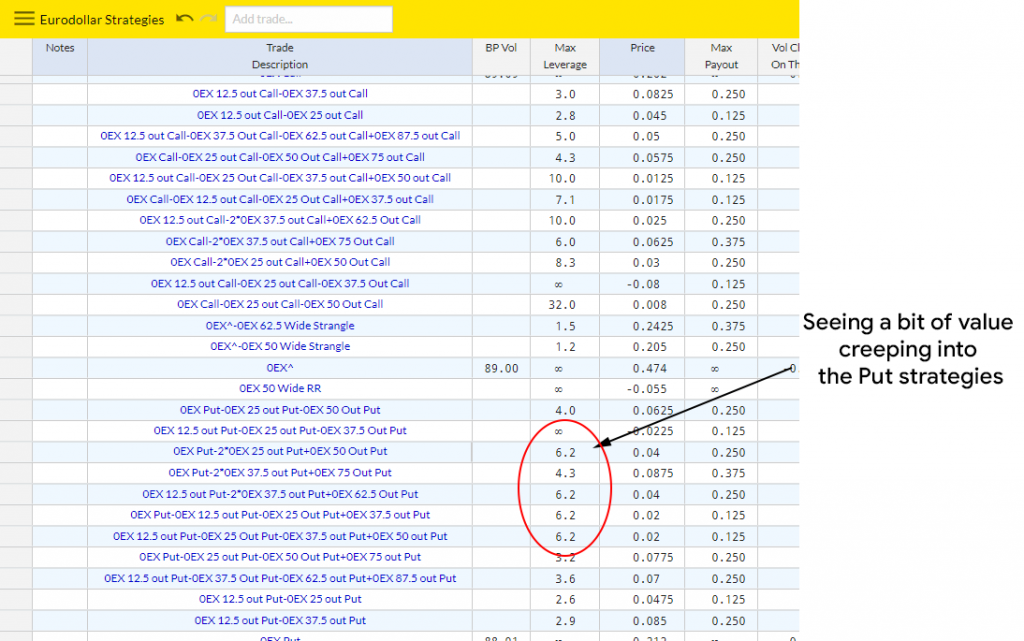

Last week we flagged call strategies that were running cheap, finally yesterday we started to see a small shift in the skew in a few of the Eurodollar expiry months that is pushing a small number of the bear strategies to offer some value.

Midcurve Nov (expiry 164 days) Put Flys are a good example of strategies that look cheaper.

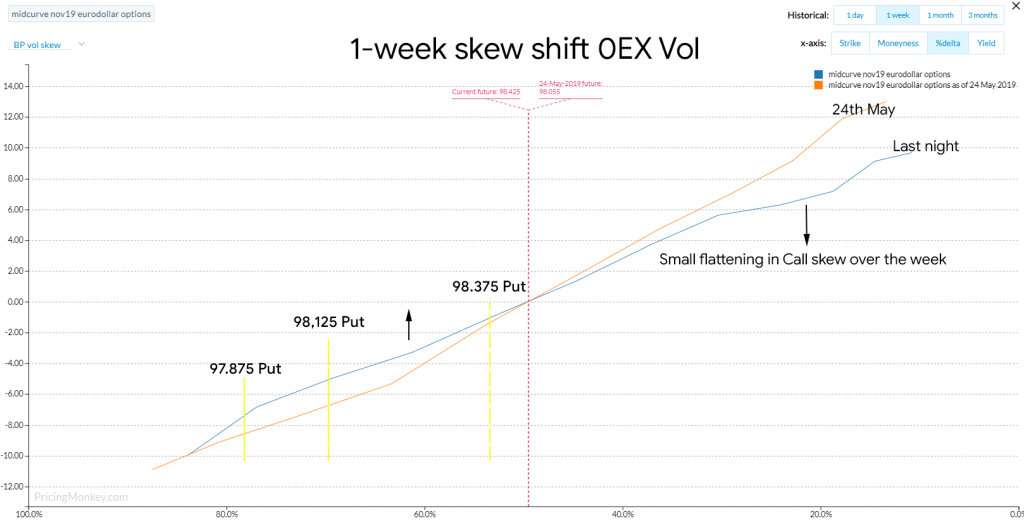

This move in Nov Midcurve value appears to have been driven by the small shift the skew over the last week. 30 Delta Puts have flattened a couple of Bbps, this has pushed up the value of 98.125 Puts relative to 98.375 and 97.875 Puts.

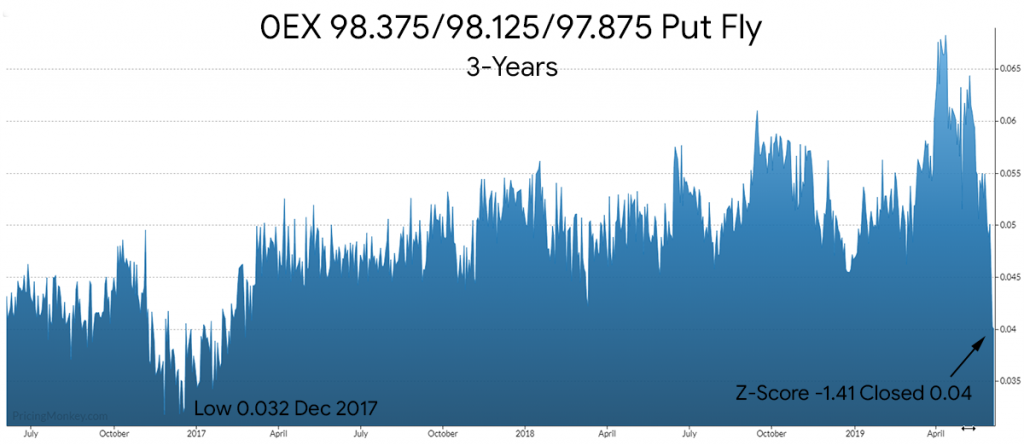

Plotting the OEX 98.375/98.125/97.875 Put Fly synthetically you can clearly see how this has impacted this package.