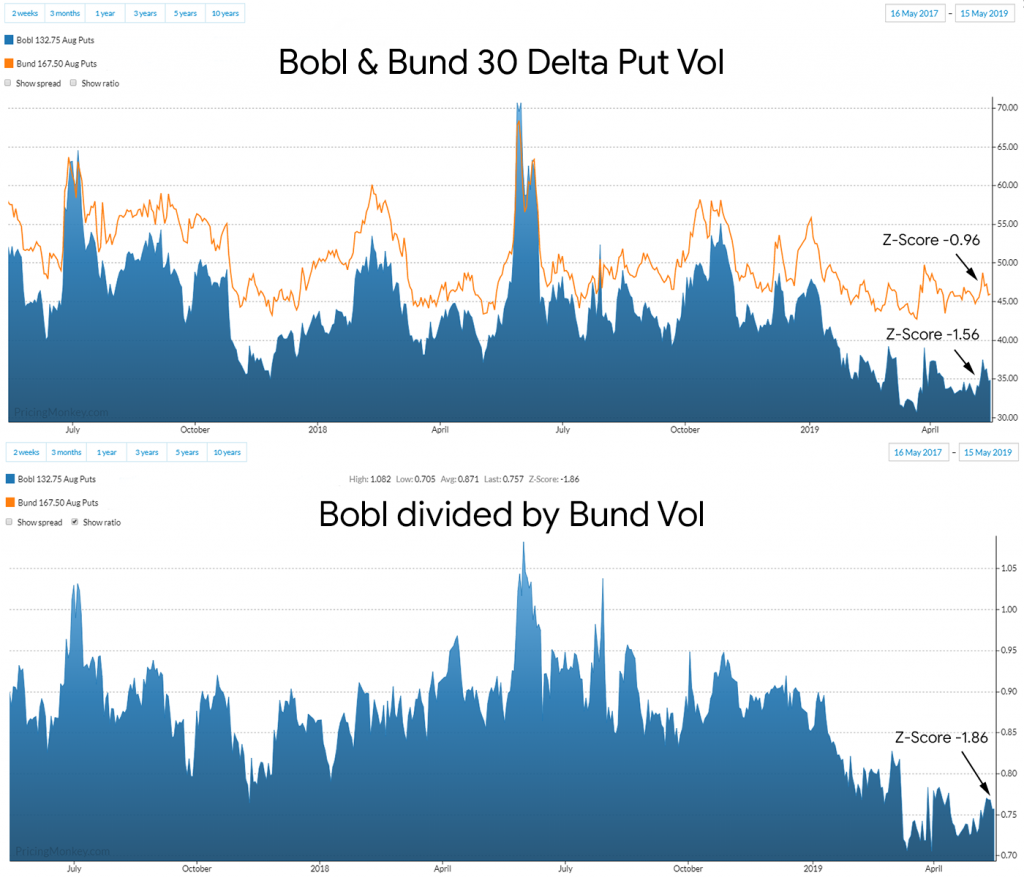

Bobl vol has been running cheap to Bund vol for a number of weeks now, although never really getting to below 10bp under until this morning, when 30 delta Puts flagged up as sub -10bp (-12.05).

Here we look at the Vol of the Bobl 132.75 Puts (delta 26.4) versus Bund 167.50 Puts (delta 32.3).

Plotting both Vols on the same chart, then selecting “show ratio”, allows you to quickly see the historic vol relationship.

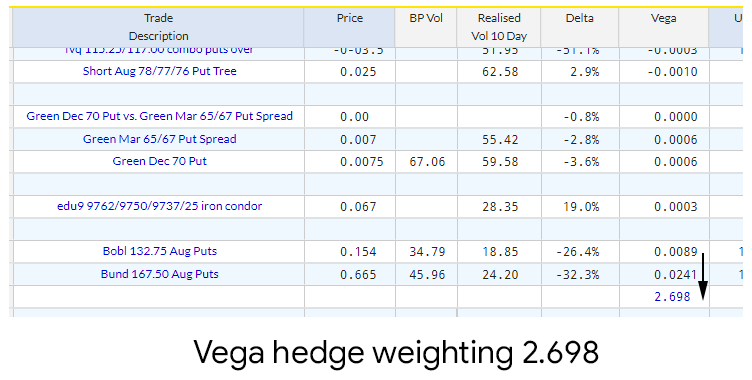

Assuming you have no major view on the German Bobl/Bund curve you can look at a vega weighted RV switch. The vega weighting can be calculated on the sheet using a formula.

With this information you can now look to create a trade that Buys 270 132.75 August Puts in Bobls and Sells 167.50 August Bund Puts. As the Bobl Puts trade @ .154 versus Bund Puts at .665 this will trade at a good credit.